Breaking Down the ACFE's Latest Fraud Report

Every two years, the Association of Certified Fraud Examiners (ACFE) releases a comprehensive study on the costs, methods, perpetrators, and victims of occupational fraud. The latest edition, "Occupational Fraud 2024: A Report to the Nations," examines over 1,900 cases of white-collar crime across 138 countries. As in previous reports, the 2024 study estimates that the average organization loses 5% of its annual revenue to fraud. However, this 5% figure is considered conservative, as many cases of fraud go undetected or unreported, and indirect losses—such as reduced productivity, reputational harm, and future business loss—are often impossible to fully recover.

Key Findings

To help assess fraud risks, business owners and managers should review the following statistics from the 2024 study.

Median Losses

Globally, the median loss caused by the frauds in the 2024 study was $145,000. The median loss for organizations with fewer than 100 employees was $141,000, compared to $200,000 for those with more than 10,000 employees. Although the dollar amount per incident may be lower for small companies than for large ones, fraud losses as a percentage of annual revenue tend to be higher for smaller victim-organizations.

Industries

Certain industries tend to be more vulnerable to fraud than others. Industries that reported the most fraud cases in the latest study include:

Banking and financial services (305 cases)

Manufacturing (175 cases)

Government and public administration (171 cases)

Health care (117 cases)

Industry fraud risks can also be gauged by how much was lost per incident. Sectors with the highest median losses per incident include mining ($550,000), wholesale trade ($361,000), manufacturing ($267,000) and construction ($250,000) companies.

Perpetrators

The biggest fraud losses were caused by dishonest owners and executives (median loss of $500,000). Significantly lower amounts were lost when fraud was committed by managers ($184,000) or employees ($60,000). Most perpetrators had no previous criminal record. But, before being caught, many white-collar criminals exhibited classic red flags, such as living beyond their means, experiencing personal financial difficulties, and having unusually close ties with vendors or customers.

Duration

The longer fraud schemes go undetected, the more financial losses they tend to cause. From start to finish, the median fraud scheme in the 2024 study took 12 months to uncover. The average loss per month was $9,900, up from $8,300 in the 2022 study.

Role of cryptocurrency

The 2024 study provides statistics on the role cryptocurrency plays in fraud. Although many people associate fraud with digital assets, the study found that only 4% of schemes involved cryptocurrency. Of those cases, crypto was most commonly used to convert stolen assets (47%) and make bribery and kickback payments (33%).

Types of schemes

The study identifies three basic types of frauds:

Asset misappropriation. This category represents 89% of cases in the 2024 study. It happens when the company's resources, such as cash or inventory, are stolen.

Corruption. Nearly half of the cases (48%) involved corruption, such as kickbacks, bribes and extortion.

Financial misstatement.These were the least common schemes (occurring in only 5% of cases). It happens when a dishonest employee — usually an executive, an upper-level manager, or an employee in the finance and accounting department — causes a material misstatement or omission in the financial statements. Examples include reporting fictitious revenue or concealing liabilities.

Median losses were lowest for asset misappropriation ($120,000) and highest for financial misstatement ($766,000). Many cases involved more than one type of fraud scheme. For example, 35% of the frauds in the 2024 study involved both asset misappropriation and corruption. Only 1% of the cases involved financial misstatement alone.

Methods of Detection

The 2024 study reports that the top ways victim-organizations detect fraud schemes include:

Tips (43%)

Internal and external audit (17%)

Management review (13%)

Employees supplied more than half (52%) of the fraud tips in the study. Other common whistleblowers included customers (21%) and vendors (11%). Anonymous reports accounted for 15% of all tips.

Reporting mechanisms are essential to encourage tips from whistleblowers. Web-based (40%) and email (37%) reporting mechanisms are now more popular than telephone hotlines (30%). For the first time in the study's history, web-based mechanisms were the most popular method for reporting suspicious activity. By comparison, in 2020, the top three reporting mechanisms were used essentially equally (about one-third of tips came from each).

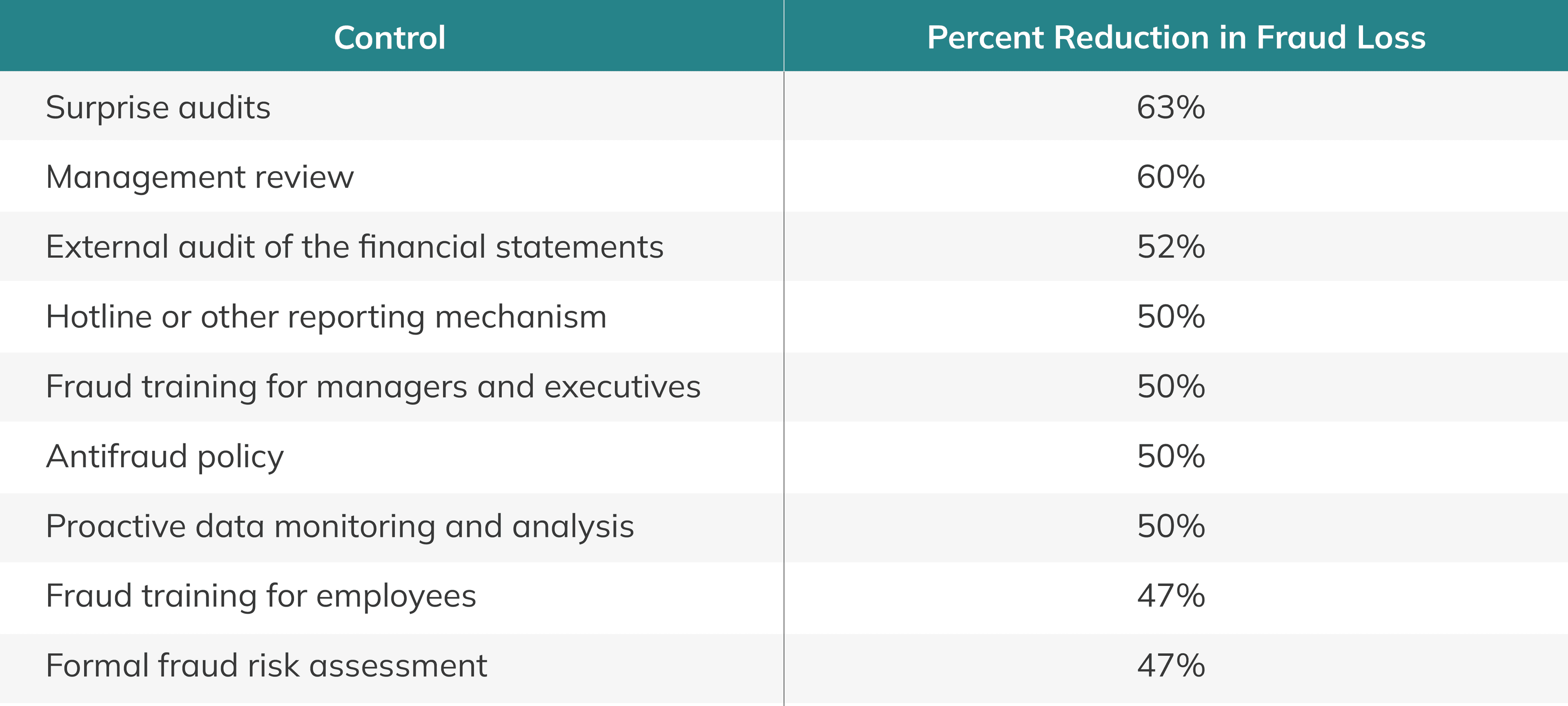

Fraud Prevention

Robust internal controls are the best defense against fraud. In terms of lowering fraud losses, the most effective internal controls in the 2024 study were:

Weak internal controls often provide dishonest people with opportunities to commit fraud. The 2024 study found that more than half of cases were correlated with lack of internal controls or management override of internal controls. Unfortunately, weak controls tend to be common among smaller organizations.

One way to strengthen your internal controls is to train executives, managers and other employees about reporting mechanisms, common schemes in a particular industry and the warning signs of fraud. The ACFE says that fraud training combined with a formal reporting mechanism dramatically increases the likelihood that your organization will receive fraud tips.

Fraud training also sends a powerful message about your intention to fight fraud no matter where it originates. Employees must perceive a high probability that fraudulent activity will be detected

Help with Fraud Prevention

CSH can strengthen your internal controls through tailored training sessions, surprise audits, and assessments of your company's specific fraud risks. If your organization currently issues compiled or reviewed financial statements, upgrading to audited financials next year may also be worth considering. Should you detect any suspicious activity, engaging a forensic accounting specialist to investigate can save your organization potentially thousands, or even millions, in losses while sending a clear message that fraud will not be tolerated.

Connect with us today to learn more about how we can help your organization avoid falling victim to fraud.

![[Case Study] Operational Discipline Turns Food Costs into Savings](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Ffldcb3509v6k%2F7nce4aq9C3oiIAx4CcKVPg%2F7cbf8a2ea11d1beb58acc3d40a7230de%2FiStock-1156240802.jpg&w=3840&q=100)