Guiding Governmental Organizations Through Single Audit Thresholds

Governmental organizations that depend on federal funding must adhere to strict compliance requirements. A key component of this oversight is the single audit, which ensures federal funds are managed appropriately. This article explores the current single audit threshold, its evolution over time, and the factors driving these changes.

Striking the Right Balance: Oversight Meets Practicality

The single audit threshold aims to balance accountability for federal funds with practical considerations for governmental entities. Changes to the threshold reflect efforts to adapt to economic conditions and streamline oversight. However, any increase comes with trade-offs, as fewer entities fall under the requirement, potentially reducing the scrutiny of federal funds.

For governmental organizations, understanding the threshold’s implications is critical to maintaining compliance and ensuring continued eligibility for federal funding. As thresholds are continually adjusted by the Office of Management and Budget (OMB), staying informed will help agencies navigate these evolving requirements and focus on serving their constituents.

By balancing financial accountability with operational efficiency, the single audit threshold remains a cornerstone of effective federal funding oversight, ensuring resources are used as intended while supporting government agencies in their vital work.

Single Audit Threshold History

The single audit threshold has gradually increased over the years to reflect economic and administrative needs. Before the most recent adjustment in 2024, the last update occurred in 2015 when the OMB raised the threshold from $500,000 to $750,000 under the Uniform Guidance. This marked the first increase in over a decade, as the $500,000 benchmark had remained unchanged since the early 2000s. Previously, the threshold stood at $300,000, highlighting a pattern of incremental adjustments. Most recently, in 2024, the threshold was raised again to $1,000,000.

Why Was the 2024 Single Audit Threshold Increased to $1M

Several factors motivated the increase:

Inflation and Economic Changes

Inflation gradually diminishes the value of money, making the earlier $750,000 threshold less significant over time. The adjustment to $1,000,000 accounted for inflation and ensured the threshold continued to target entities managing substantial federal resources.

Administrative Efficiency

Single audits are resource-intensive, both for the organizations being audited and for federal agencies conducting oversight. By raising the threshold, federal resources could be concentrated on larger grants, where potential risks and impacts are greater, while smaller governmental entities faced fewer compliance burdens.

Reducing Burden on Small Governmental Entities

The change also sought to ease the financial strain on smaller governmental agencies. For many entities just above the previous $750,000 threshold, the cost of conducting a single audit was disproportionately high relative to their funding. By raising the threshold, these agencies could allocate more resources toward essential public services.

What Does This Mean for Governmental Organizations Receiving Federal Funding?

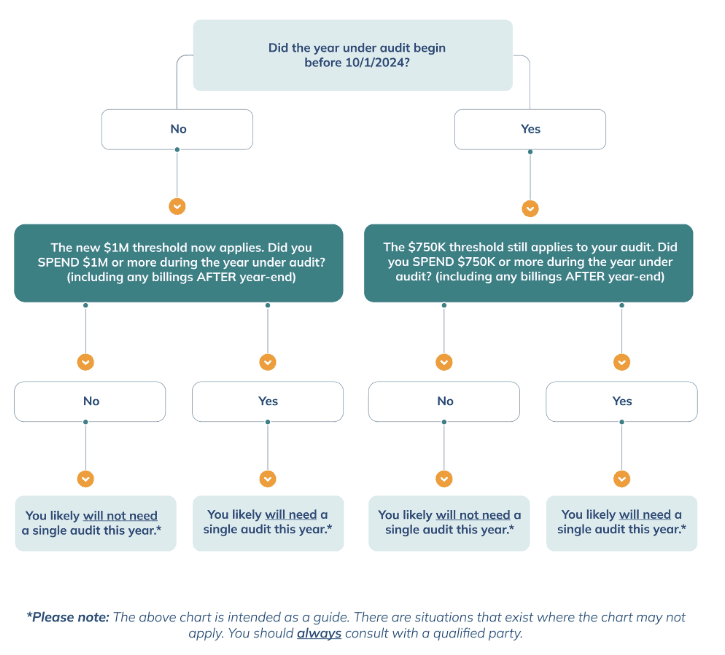

The new single audit threshold took effect on October 1, 2024. However, your agency may not be immediately impacted. The $1,000,000 threshold applies to fiscal periods beginning after this date. As such, changes to the audit threshold and Type A program threshold cannot be adopted until audits for years ending September 30, 2025, or later as prescribed by the 2024 OMB Compliance Supplement in Appendix VII. So, if your year-end date is before September 30, 2025, you will have to wait one more year before you see the changes.

Refer to the chart below to determine which threshold currently applies to your organization.

What else did OMB change with that ruling?

Major Program Determination: The threshold for identifying Type A programs has increased to $1 million if the total annual expenditures of all federal programs for a non-federal entity are $34 million or less (an increase from $25 million or less).

Internal Controls: Recipients and sub-recipients must include cybersecurity measures and other safeguards in their internal controls.

Indirect Costs: The de minimis rate for indirect costs for recipients and subrecipients without a current federal negotiated indirect cost rate (including provisional rates) has been increased from 10% to a maximum of 15% of modified total direct costs.

Equipment Threshold: The threshold for equipment consideration increased from $5,000 to $10,000.

Subaward Exclusion Threshold: The exclusion threshold for subawards has been increased from $25,000 to $50,000 for modified total direct costs.

Help with Single Audit Thresholds

Don’t hesitate to reach out to us at CSH if we can help your governmental organization navigate these waters. Determining if a single audit is necessary for the upcoming year is not always obvious and is one of the many ways that we can support your agency.