How One Manufacturer Boosted Profits With Cost Segregation

On behalf of our manufacturing client, CSH performed a cost segregation depreciation analysis for a building which was purchased and then renovated.

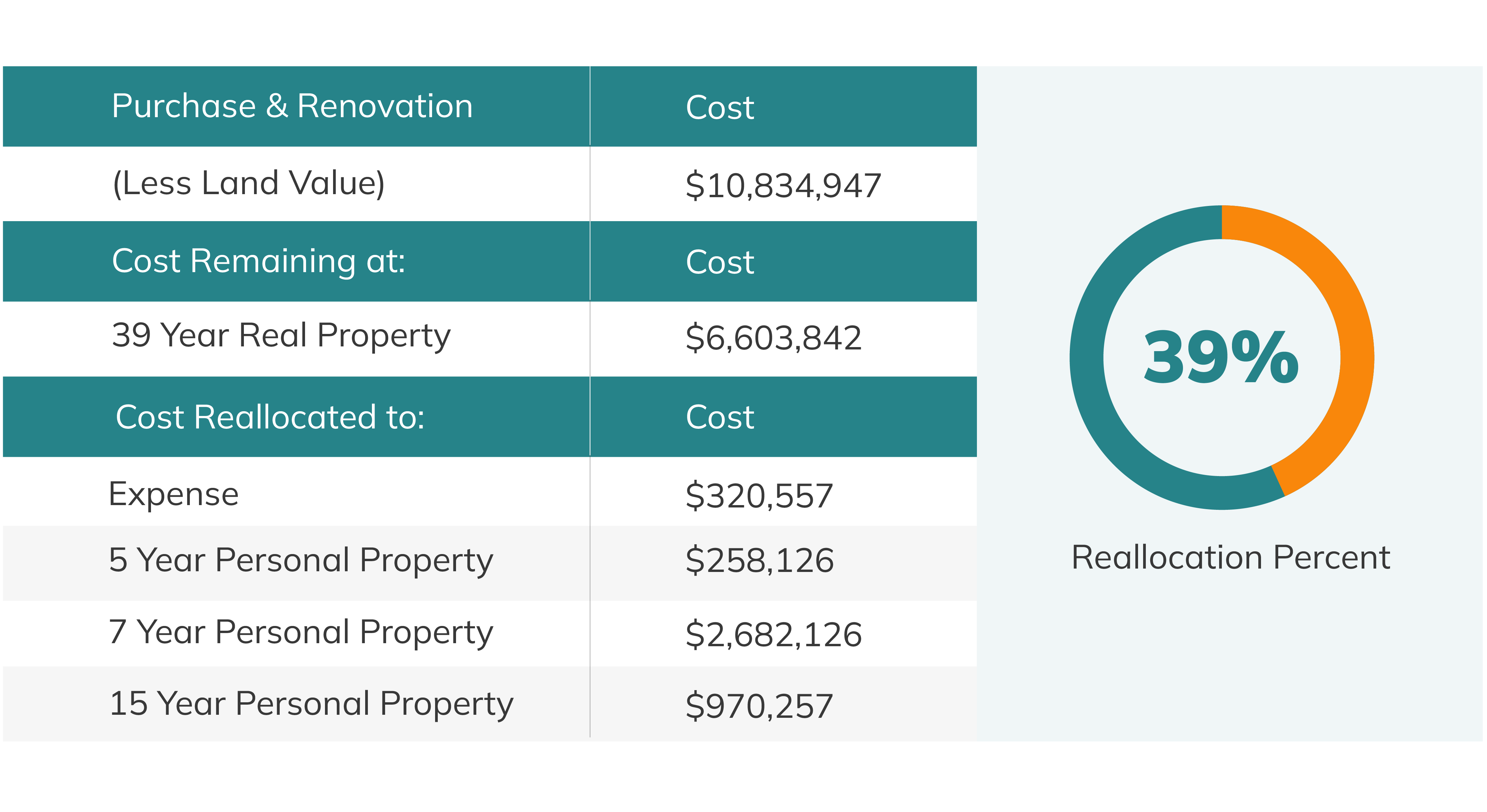

The total cost for the purchase as well as the renovation amounted to $10,834,947.

Property Details

Sitting on 1.5 acres of land, the building is two stories with 108,412 square feet of space. Most of the space is used for the company’s manufacturing operations, which includes handling, packaging and storage equipment. The facility includes multiple administrative offices, storage space and several loading docks for shipping and receiving. The exterior of the building includes a parking area and driveway, concrete sidewalks, fencing and building lighting. Other exterior improvements include a parking canopy, concrete bollards, entry steps and a fire hydrant.

Depreciation Benefit and ROI

Approximately 39% of the project’s real property was reallocated to personal property, which has a shorter depreciable life or could be expensed. This acceleration in depreciation expense resulted in increased cash flow in years 1-5 of $589,070. Additionally, the company realized a $498,764 net present value benefit through the front-loading of depreciation expense (remember that the time value of money tells us that money available at the present time is worth more than the same amount in the future due to its potential earning capacity).

Given the NPV benefit of $498,764* and after-tax cost segregation study fee of $8,850 our client realized an ROI of 56 to 1 by conducting the study.

*Assuming an aggregate federal and state tax rate of 41% and a discount rate of 8%

At-A-Glance

Purchase & Renovation Cost (Less Land Value) = $10,834,947

Cost Remaining at 39 Year Real Property = $6,603,842

Cost Reallocated to 15 Year Personal Property = $970,257

Cost Reallocated to 7 Year Personal Property = $2,682,126

Cost Reallocated to 5 year Personal Property = $258,126

Cost Reallocated to Expense = $320,557

Reallocation Percent = 39%