Green Energy Incentives

Environmentally Friendly Tax Savings

Whether you’ve already invested in green energy equipment or just want to learn more about existing tax incentives, CSH is the right partner to help you achieve maximum tax savings.

There are federal and state tax credits, plus additional rebates and incentives that can be stacked to save businesses money on green energy equipment. Businesses can also write off the depreciation of equipment, and depending on the state, the solar system may be exempt from the business’s property tax bill.

What type of credit is right for you?

The Inflation Reduction Act of 2022 significantly extended and enhanced green energy benefits for both individuals and businesses, which has made these investments even more lucrative. This federal law further incentivizes clean energy production while encouraging taxpayers to meet strong labor and material standards. However, there are many factors that determine your credit or deduction amount.

179D – Energy Efficient Commercial Building Deduction

The Energy Efficient Commercial Building Deduction (commonly referred to as “179D”) provides a federal tax deduction to those who construct or remodel commercial buildings or apartment buildings. This deduction, which can be up to $5.00 per square foot of eligible building space (adjusted for inflation depending on the relevant year), allows owners/developers of buildings that meet certain green energy standards to benefit from the green energy investments they’ve made. In addition, certain building designers may be eligible to receive the deduction on government or not-for-profit projects (i.e. schools, libraries, airports, municipal buildings, etc.). In addition to 179D, there are two types of solar credits a business could be eligible for:

1. Investment Tax Credit

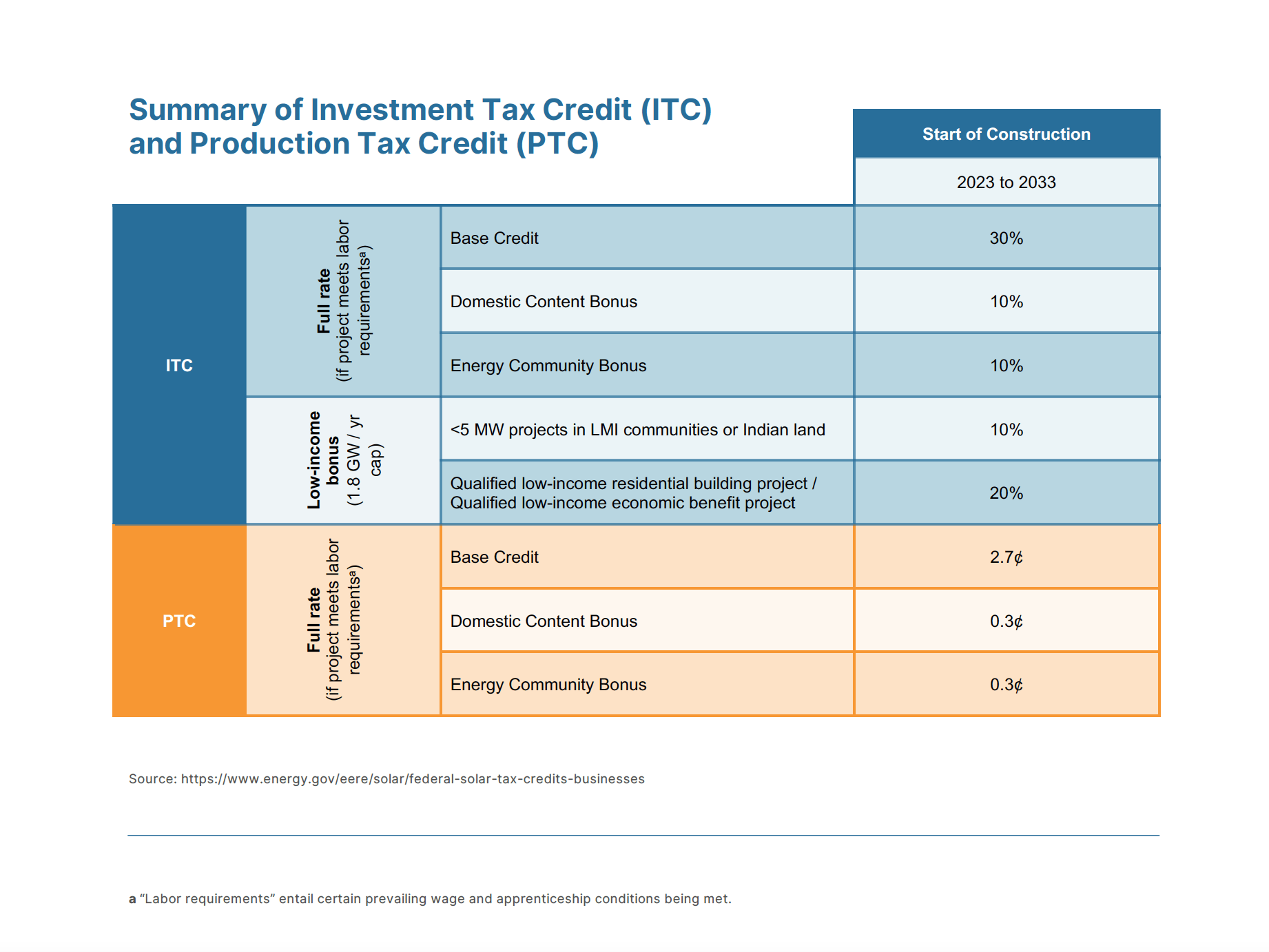

An investment tax credit (ITC) provides a federal tax credit for a percentage of the cost of a solar system that is installed during the tax year. It’s important to understand the calculated ITC is based on specific expenses that are eligible, not necessarily what you might consider the total cost. With a potential credit of up to 70% of the eligible basis and only a 50% basis offset, this is a tremendous opportunity for a business to capitalize on.

2. Production Tax Credit

A production tax credit (PTC), the second type of solar credit, is a per kilowatt-hour (kWh) credit for electricity generated by solar and other qualifying technology sold to a third party. There is plenty of fine print associated with these options, including the premise that qualifying equipment much be less than 10 years old. For this reason, it’s a great idea to engage with a seasoned tax professional who can advocate for and advise you. This is where you can leverage Clark Schaefer Hackett’s expertise.

Maximizing Your Return on Investment

Leveraging a partner like CSH, will ensure you are securing the largest return on investment (ROI). Between labor requirements, bonus credits, phase-out and tax exemptions, there are a wide variety of considerations that must be factored in to receive maximum credit and deduction amounts. Additionally, there are bonus credits to consider. Both the ITC and PTC offer additional credits—including the Domestic Content Bonus, Energy Community Bonus and Low-Income Bonus—all which have their own sets of requirements.

Related Services

Streamlining Tax Strategies for Business Success